Frequently Asked Questions

- When is the Liquidator appointed?

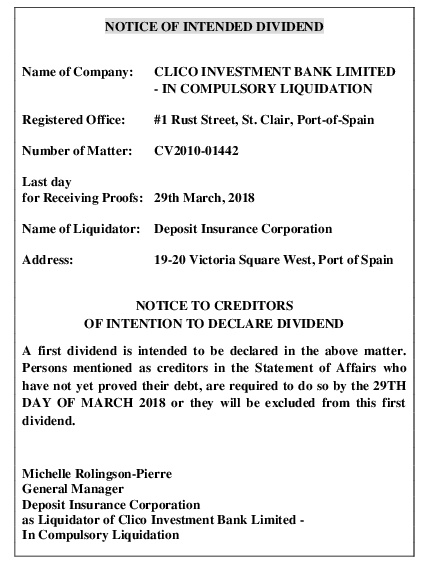

- If a depositor has more than $200,000 (the current insured limit) in a closed institution and is paid $200,000 by the DIC, what happens to the amount in excess of $200,000?

- How is a depositor notified that an institution in which he or she has a deposit, has been ordered to be closed?

- Must a claim be filed in person?

Did You Know?

- Misconception: Depositors of a failed member institution would receive payment immediately upon closure of the failed member. - Fact: The legislation governing the operations of the Deposit Insurance system provides for payout to commence within 3 months of the closure of a member institution.