The International Association of Deposit Insurers (IADI) defines Deposit Insurance Coverage as, “the maximum amount which a depositor can claim from or be reimbursed by a Deposit Insurer in the event of a Bank failure.”

In Trinidad and Tobago, the coverage limit now stands at TT$125,000 per depositor, per Deposit Insurance Fund member institution. This coverage is extended separately to each depositor in three different rights and capacities:

- Individual account.

- Joint account.

- Irrevocable express trust account.

A depositor, therefore, can obtain a maximum of TT$375,000, assuming they maintain deposits in all three rights and capacities at a member institution prior to failure.

The residency status or nationality of depositors has no effect on the coverage level afforded to depositors of member institutions. The coverage is limited to Trinidad and Tobago dollar savings, chequing and fixed deposit accounts. The coverage limit does not apply to foreign currency accounts, inter-bank deposits or deposits of a bank’s parent and affiliates since these are not covered under the deposit insurance system in Trinidad and Tobago.

A depositor can obtain a maximum of TT$375,000, assuming they maintain deposits in

all three rights and capacities at a member institution prior to failure.

It is important to note that depositors do not pay for this coverage and it is only extended to depositors in the event of the failure of a member institution and trigger for a pay out by the Central Bank of Trinidad and Tobago.

International Standards

Consistent with the IADI’s international standard on coverage – Core Principle 8, the DIC’s coverage is, “limited, credible and covers the large majority of depositors but leaves a substantial amount of deposits exposed to market discipline.”

The current coverage of TT$125,000 covers approximately 96% of the volume of accounts and 24% of the value of deposits held by the member institutions of the Fund. The level and scope of coverage is applied equally to all members of the Fund.

The DIC reviews the level and scope of coverage periodically as is required by the international standard. When the DIC was established on September 17, 1986 by Act No. 2 of 1986, the coverage limit was set at TT$50,000 and was subsequently changed on two occasions. By Legal Notice No. 237 dated 16th October, 2007 the limit was increased to TT$75,000, and by Legal Notice No. 10 dated 17th January, 2012 the limit was increased to TT$125,000.

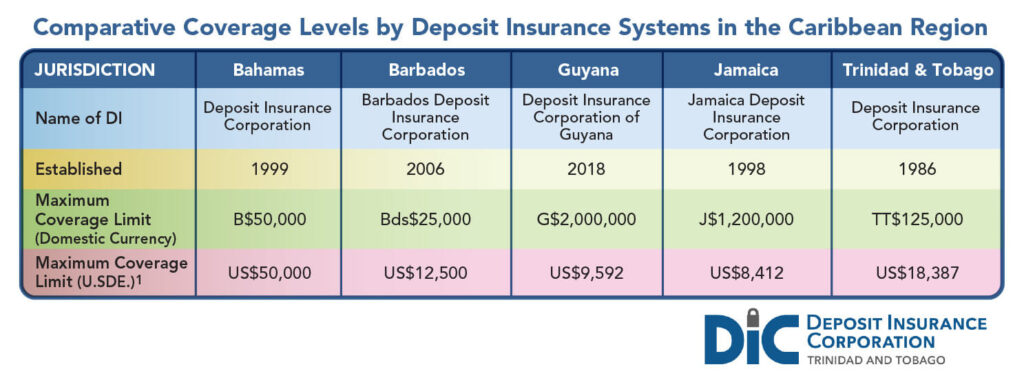

Caribbean Region – Comparative Coverage Levels

Level & Scope of Coverage… How we keep you in the know!

As part of the DIC’s public awareness program, the level and scope of the coverage are shared with the public through various sources including, but not limited to, the DIC’s enabling legislation, Facebook, Instagram, LinkedIn, Newspapers, Magazines, the DIC’s website and DIC Online Training and Bulletins to member institutions. These disclosures are consistent with the International standard – Core Principle 8, which states that, “Policymakers should define clearly the level and scope of deposit coverage.”

By now, you should know if your institution and funds are covered. The next step is to ensure you’re taking advantage of the three rights and capacities to get as much coverage as possible. As always, if you’re not sure, don’t be afraid to ask!

1 The TT:US dollar exchange rate sourced from the Central Bank of Trinidad and Tobago’s websites as at December 31st, 2020. All other US dollar conversions were provided by the respective deposit insurance systems.