The Deposit Insurance Corporation (DIC) was established by the Central Bank and Financial Institutions (Non-Banking) (Amendment) Act, 1986 which amended the Central Bank Act Chapter 79:02 to provide protection to depositors against the loss of their insured deposits in the event that a member institution is closed.

A member institution (MI) is an institution which is licensed under the Financial Institutions Act, including a licensed foreign financial institution in respect of its deposits held in Trinidad & Tobago. When the Central Bank of Trinidad & Tobago (Regulator of Banks) closes a MI, the DIC’s powers can be activated. One such power is the power to act as receiver or Liquidator of a MI in the event that such a member becomes insolvent.

Liquidations

Liquidations are conducted under the Companies Act, Chap 81:01 and refers to the winding-up of the business affairs and operations of a closed MI through the orderly disposition of its assets and converting them into cash to pay the MI’s secured and unsecured creditors in proportion to its confirmed indebtedness to each creditor. In addition, the powers of Directors in the closed MI cease and the Liquidator takes charge of the assets of the MI. Furthermore, no court action or proceeding can be continued or commenced against the MI without the permission of the Court.

The Liquidator

Duties to Creditors

The Liquidator, when appointed, has a duty to its creditors. The Liquidator’s powers under the Companies Act, Chap 81:01 includes but is not limited to:

- Taking control of and realising a company’s assets in order to distribute the monetised assets to creditors.

- Bringing or defending Court proceedings in the name of the company, to recover debts due to or dispute debts alleged to be owed by the company. This includes bringing a legal action with a view to recovery from directors of the company.

- Carrying on the business of the company to the extent that this is necessary for the beneficial winding up of the company.

- Paying debts and compromising/reaching a settlement on claims and liabilities of the company.

- Selling any real or personal property of the company.

- Executing deeds, receipts and other documents in the name of the company.

- Doing all such other things as may be necessary for winding up the affairs of the company and distributing its assets.

Powers

Moreover, the Liquidator’s powers in a compulsory winding up, are subject to the control of the Court and any creditors or contributories may apply to the Court with respect to any exercise or proposed exercise of any of those powers. The Liquidator may also apply to the Court for directions on any matters arising under the winding up of the MI.

Dividend Distribution

Another important aspect of Liquidation is Dividend Distribution. In order for creditors to receive a dividend distribution, they must first submit a “Proof of Debts/General Form” (Form 55). Creditors are required to prove their claims which the Liquidator may admit or reject, in whole or in part, or request further proof of the debt. Once the Liquidator admits the claim, the Creditor will be advised of a dividend distribution once the assets of the closed MI have been monetised.

Dividend distributions are traditionally paid in cash, however, for any other form of distribution, the Liquidator would solicit the support of the creditors and the sanction of the Court. Where there is a lengthy liquidation, an interim dividend may be paid (of so many cents on the dollar). If 100% payment on claims cannot be made, each unsecured creditor would be paid an equal proportion of the amount owed to the creditor (pari passu).

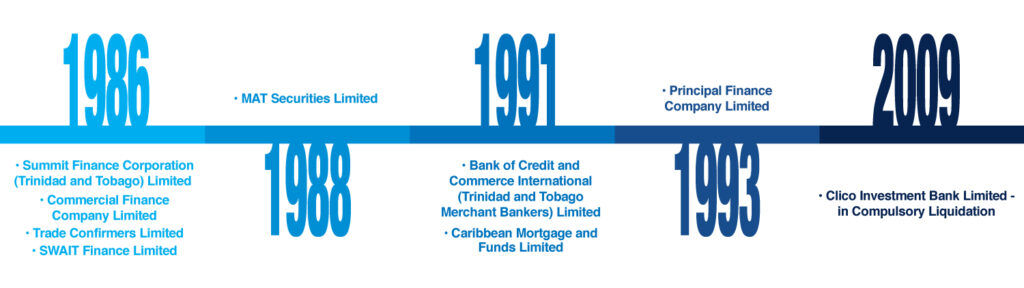

Liquidations to Date

The DIC, from its inception in 1986 to present, has liquidated a total of nine MIs, the most recent being Clico Investment Bank Limited – in Compulsory Liquidation, one of the largest liquidations in the Republic of Trinidad & Tobago.

References

- Deposit Insurance Corporation Website

- Central Bank Act Chap 79:02

- Companies Act Chap 81:01