Ex Ante Funding

The Deposit Insurance Premium represents a key source of the funding for the Deposit Insurance Corporation (DIC), which functions as an ex ante system. This type of funding system as defined by the International Association of Deposit Insurers (IADI) is based on, “the regular collection of Premiums, with the aim of accumulating a fund to meet future obligations (e.g. reimbursing depositors) and cover the operational and related costs of the Deposit Insurer.”

Annual Premium

The premium rate is a flat rate based system as it is assessed at a uniform rate across all the member institutions of the Deposit Insurance Fund. Membership in the Fund is compulsory for every institution licensed under the Financial Institutions Act, 2008. Members of the Fund are required to pay an annual premium which is based on the application of 0.2 per centum of the aggregate of the deposit liabilities of the member’s outstanding at the end of each quarter of the first twelve months of operation divided by four.

New Members

Prior to the payment of annual premium, new members are required to pay an initial contribution which is based on the application of 0.4 per centum of the aggregate of the deposit liabilities of the institution’s outstanding as at the end of the first and second quarters of the first twelve months of operation divided by two.

The Central Bank of Trinidad & Tobago contributes to the Fund sums in equal value to the initial contribution made by the new members. The qualifying deposits for premium assessment represent the total deposits, excluding those instruments not covered by the Fund, such as foreign currency deposits, inter-bank deposits, deposits held by members’ parent, subsidiaries and affiliated companies, mutual funds and bankers’ acceptances.

Emergency Funding

In the event of the need for emergency funding, the DIC has the power to consult with the Minister of Finance to require members to make special contributions where the Fund has made or is likely to make payments to depositors which may exhaust the Fund.

Managing the Fund

In accordance with the IADI standard – Core Principle 9, the DIC is responsible for the sound investment and management of its funds, including the premiums received from its members. The DIC has established an investment policy that aims to:

- Maintain capital value.

- Provide an adequate liquidity profile.

- Reasonably grow the Fund.

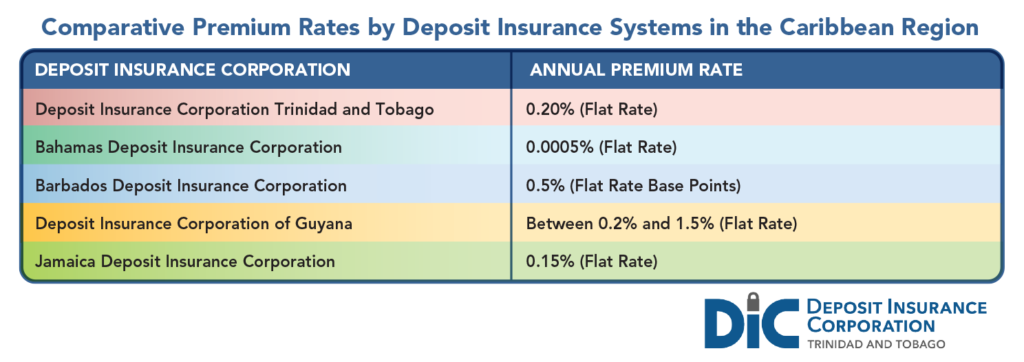

Caribbean Region – Comparative Premium Rates

All of this might sound complicated, but it’s our way of ensuring that we can help whenever the need arises. Make sure your savings have protection on the money… ask your financial institution if you’re covered today!